This blog is no longer active and was supported from 2009-2010.

Can CAR transform the politics of cap-and-trade? Update for visual thinkers

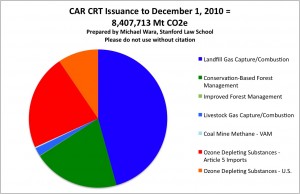

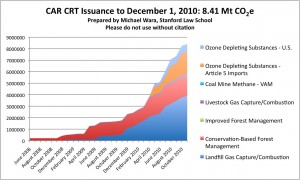

I just updated my data for the Climate Action Reserve’s (CAR) issuance of offsets to reflect activity during the month of November. November was a relatively slow month with only 158,000 tons of offsets, called Certified Reduction Tons (CRTs), issued by CAR. One new state entered the picture, Kansas, with the issuance of a sizable chunk of offsets from a landfill methane management project. As of December 1, 2010, the total offset volume verified and issued under the CAR protocols comes to 8,407,713 tons. See figure 1a and 1b for a picture of the developing market for US offsets.

Figure 1a: CAR Offset Issuance by Project Protocol to December 1, 2010.

Figure 1b: CAR Offset Issuance by Project Protocol as a function of time to December 1, 2010.

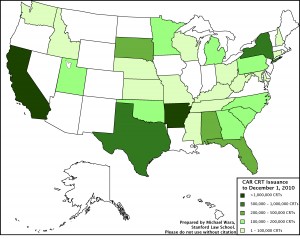

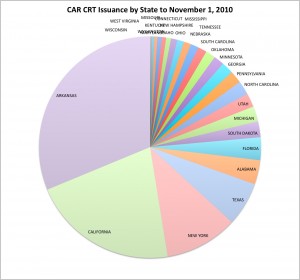

In an effort to better illustrate and understand the political economy of the developing domestic offsets market, I created Figure 2, showing the distribution of offsets by state. It helps to drive home the point that CAR is fast becoming a program of national scope that should, over time, build constituencies in a number of states that will push for adoption of federal cap-and-trade legislation. Offset project owners will do this for no other reason than that it will increase the value ($/CRT) of their projects. Of note, CAR is currently forming working groups to develop two agricultural offset protocols. These protocols hold the promise of both producing significant tons for the California compliance market, if adopted by CARB as compliance grade protocols, and of adding a politically significant industry to the emissions trading constituency.

Figure 2: Origin of CAR Issued Offsets by U.S. State to December 1, 2010.

Ozone Depleting Substances Redux – Instrument choice

First off, thank you to the many people that have responded, both via email and in the comments section of the blog. The point of a blog is to elicit a conversation, and that has certainly ensued. The comments have all been very thoughtful and needless to say, I’ve learned a lot. I strongly recommend that readers take the time to read through them. I’ve also continued reading on the issue and have a few more thoughts to add.

All ODS projects are not created equal

First off, as Jeff Cohen of EOS Climate is at pains to point out, it is important to distinguish between so-called “virgin” stockpiles of ODS that exist in both government and private hands in developing countries and the more dispersed banks that are where most ODS reside. The stockpiles were the focus of my previous post. Cohen states that, as far as he knows, government stockpiles currently eligible for import into the US for destruction under the CAR protocol, are relatively small – on the order of 300,000 tons. If that estimate is accurate and the total mass of ODS in government hands is not growing, then this is probably not worth focusing too much attention or effort on. On the other hand, we’ve already seen close to 2 million CRTs (23% of issued credits) enter the market from virgin stockpiles to date. Presuming that these are the last of the privately held stockpiles that made it into CAR before the deadline for private stockpiled imports closed, this represents about 2 months of issuance at current rates and is perhaps not something to be too concerned about as well.

The more interesting and important question then is, what do we do about the dispersed banks of ODS, both in developed and developing countries?

These are (relatively) small volumes of gas incorporated into things like building HVAC systems, large industrial chillers, residential refrigerators, and the like. The big question is instrument choice for these dispersed ODS banks, in developed and developing countries. In developed countries, most of this gas is recycled under current law and regulation with only the fraction that is too polluted to clean up being destroyed. In developing countries, the extent of recycling is less clear.

In my previous post, I made the argument that these dispersed banks would be better addressed under the auspices of the Montreal Protocol for developing countries. Many in the ODS offset community argue that carbon markets are essential. For developed countries, I think there are real questions that need to be answered before we rush into a carbon market approach.

Dispersed ODS in developing countries

A key point of negotiation at the most recent MOP, second only in importance to the issue of an early HFC phaseout, were the developing country banks of ODS. There is a desire on the part of some to utilize the Multilateral Fund (MF) of the Montreal Protocol, mentioned in my previous post, to begin dealing with the problem of banks. There are two big problems with an MF approach - one financial, one legal.

The more important of the two can be summed up with one word: money. It would cost quite a bit - estimates vary but on the order of 50-150 billion dollars over 10 years - to deal with the existing and predicted ODS banks. The MF doesn’t operate with nearly this large of a budget and so would need substantial additional resources to take a crack at it. On the other hand, the last time I checked, that’s about what was being promised on an annual basis for long-term climate funding to the developing world in 2020. Of course one might not actually believe that the developed country parties to the Copenhagen Accord have any intention (or are capable of making a credibly commitment) to long-term climate finance. Given that the MF as an institution has demonstrated long-standing success in assisting (capacity and finance) developing countries with implementation of relatively complex regulatory programs, it might then make sense to utilize at least a part of the climate finance to fund the MF for these activities. This funding would have the advantage of helping to insure both a rapid reduction in GHG emissions and a more rapid repair of the ozone layer - a double dividend of sorts. Further, since the MF operates on a 3-year budgeting cycle, it would be possible to gradually increase the scale of funding for bank-related activities as they proved their success. To sum up, the use of a portion of the funds promised to 2020 for climate to fund an expansion of MF opportunities would be a highly credible alternative to the current situation where MRV of both the sources and the uses of climate finance is one of the key issues at the climate negotiations.

A separate but not unimportant problem is that there is an unclear legal basis for the MF to engage in abatement of banks. The Montreal Protocol was never designed to regulate banks - it governs production and consumption of ODS, not their ultimate fate post-consumption. One response is to suggest that the MF is not actually regulating anything - of course it is used to assist developing countries in complying with their Montreal Protocol obligations, but so long as this new role did not conflict with its mandare, then there need not be a problem with a bit of mission creep. A better response is to argue that the Montreal Protocol has been amended numerous times - it is a living document. The addition of control measures aimed at banks after phase-out need not be unprecedented. Indeed, provided the banks targeted were post-phase out (eg CFC-11 and -12), then there wouldn’t even be a conflict with the Montreal Protocol’s method for accounting for consumption of ODS. One could add an Article that stated that all nations were responsible for managing their ODS banks post-phase out to the maximum extent feasible and then provide that Article 5 countries would be provided agreed incremental cost funding for such activities via the MF.

Dispersed ODS projects in developed countries

So what about the United States? Should we use the carbon market or traditional regulatory measures (command and control) to handle ODS banks? I think the best answer is probably both. My view is that a market based approach is appropriate for situations where the regulator lacks either (1) capacity to get the job done or (2) the information necessary to identify and abate sources of pollution or (3) where the market can do the job for a lower social cost than a more traditional approach. We have evidence from a number of regulatory programs as to the effectiveness of a traditional approach to ODS bank management, most notably from Australia. Jeff Cohen of EOS Climate argues that this program has been ineffective and has led to widespread venting. People I spoke with both in government and in academia in Australia beg to differ and regard the effort as “pathbreaking.” I do not know enough to be able to comment here, except to say that there is a debate on the issue.

What seems clear is that some sources will be easier to manage than others. HVAC systems in large commercial buildings: easier - these ODSs are already recycled. Insulating foams in residential refrigerators: harder. Perhaps the right approach would be to phase in regulatory controls for destruction for the lowest cost most easily identifiable ODS banks in developed countries (a Montreal Protocol TEAP study could no doubt identify these quite easily) and leave the remainder for the carbon market - with periodic updates to the split between regulatory and market-based efforts. The effect of this would be to leave to the market what the market does best - creating incentives to cost-effectively abate hard to identify or control emissions sources - while leaving to the regulators what they do best - abating easily identifiable sources of pollution that are relatively small in number.

Could EPA or CARB implement such a program? Absolutely. The issue is political will. The road that the Climate Action Reserve has taken, making all offsets from ODS destruction additional, makes this mixed outcome, far less likely.

Comments on Ozone Depleting Substances and the Climate Action Reserve

I received an unusually large and detailed number of comments on my post regarding ozone depleting substances. In the hope that people will read them and then evaluate my responses in their light, I’ve taken the liberty of posting them below rather than leaving them in the comments to the original post.

Two extended comments are from the co-founder of an important ODS offsets developer (Jeff Cohen), one from a carbon fund manager (Alex Rau), another from a participant in the CAR ODS development process (Thomas Grammig), and yet another from a CAR board member who is also a senior scientist at NRDC (Peter Miller). The comments raise a number of important clarifying points and largely attempt to rebut the arguments I make in the earlier post. Look for a response shortly.

From Jeff Cohen of EOS Climate:

1st Email:

My company, EOS Climate, has generated CRTs under the new CAR ODS protocol by destroying CFCs collected from end-of-life refrigeration and A/C equipment. The CFCs under business as usual would have been either recycled back into other older equipment (and leaked during equipment operations), or not collected and vented through poor servicing practice.

Your blog - starting with the title implies there is room for perverse incentives but I don’t see any. We compete with a robust secondary market for the CFCs. If we are not able to secure those CFCs, they will be emitted. Unlike the case for HCFC-22/HFC-23, the CFCs that are destroyed cannot be replaced with more production.

Your primary concern is with the 10-year crediting period and the possibility that governments could increase regulatory controls and thus remove additionality or otherwise reduce the environmental value/integrity of credits. First, the 10 year crediting period is conservative - CFC based equipment leak at a rate of 20-50% per year. At that rate, absent new production, most of the remaining CFC refrigerant inventory will be gone within 5 years. Modeling by the IPCC and Montreal Protocol TEAP project full release of accessible ODS banks by 2015-2020 under business as usual.

Second, any additional controls are unlikely. The Parties to the Montreal Protocol have learned from experience in Australia and the EU that mandating ODS destruction has backfired - requiring hundreds of thousands of equipment owners and facility operators to report, aggregate, transport, and destroy their ODS, at their expense, with little enforcement capacity given the number of diffuse sources, has resulted in venting. The Parties have sought to encourage responsible management (collection/recycling) and the US is now seeing that a market-based incentive for destruction is the best approach. Your blog incorrectly states that the Parties are opposed to carbon finance as an approach to ODS banks. The TEAP has consistently concluded that given the limited funding available from the Multilateral Fund, carbon finance, supported by strong standards and verification, can indeed provide the most cost-effective and viable mechanism for the sound management of ODS banks.

2nd Email:

Glad to be able to have this dialogue with you and that you will be posting a follow-up. Feel free to reference my comments in the prior email and what follows here. We can add/rebut/clarify/etc.

To round out the conversation, I think it’s easiest to respond to the points in your last email.

1- Not all Article 5 CRTs are alike. Just as we distinguish the ODS CRTs that we have generated through destruction of CFCs recovered from equipment in the U.S., there is an important differentiation in discussing “Article 5 ODS CRTs”. Those issued to date all involved destruction of privately owned, virgin CFCs stockpiles - following February 3 adoption of the CAR protocol, there was a relatively short window for this type of project (shipment of the virgin stockpiles by June 30, 2010). EOS did not engage in any of these projects.

In contrast, destruction of CFCs recovered from equipment in Article 5 countries continues to be eligible under CAR. Like our projects in the U.S., destruction of CFCs that would otherwise be recycled back into old equipment in developing countries creates incentives for a market transformation that will not only prevent direct GHG emissions but speed deployment of more efficient, climate friendly technologies.

2- We don’t know how much privately owned, virgin ODS still remains in Article 5 countries - regardless, those inventories would not be eligible under CAR.

We know of a small handful of government stockpiles where the CFCs could be put back into use. These stockpiles would be eligible for CRTs but the countries involved could decide to preserve the CFCs for domestic needs. The Montreal Protocol does not track these inventories - my sense is that these stockpiles add up to about 300,000 tons of CO2eq. Not much relative to the estimated amounts in use as refrigerant or tied up in insulation foam.

3- On process, I will defer to CAR but I can share with you some of my perspective. In April 2009 I believe, CAR convened a public workshop to discuss the ODS protocol and I believe one on N2O. They held it in DC, partly to allow full participation across the spectrum, including NGOs. I specifically told my contacts at the major NGOs about it and I recall that at least some attended. CAR solicited requests to be on the working group at that workshop and I believe on their website. My guess is that none of the NGOs signed up.

The working group had a wide range and deep technical expertise that was directly relevant to the technical and policy issues underlying the Protocol. The working group included representatives from the US EPA, CARB, Pew Climate, and the Montreal Protocol TEAP - perhaps not environmental advocates in the conventional sense but I can say that the core motivation behind most of us on the working group was to eliminate unnecessary ODS banks and prevent GHG emissions.

The public meeting on the draft protocol in December 2009 was attended by NGOs - I met with at least one and I recall one made a public statement (supportive) and submitted written comments. I believe the November-December comment period was established and announced when the Protocol development process began earlier in the year. CAR has been explicit that the Protocol is a living document that will be updated with additional data, technologies, policies, etc. and my experience is that they are open to any substantive input at any time.

As you say, the California AB 32 compliance protocol is more critical. Over the past 9 months, ARB has had a series of public meetings and have issued draft documents on the ODS protocol to solicit public input. Again, I believe at least a few of the major environmental NGOs have participated and have voiced their general agreement.

We absolutely agree with you that securing support from a broad range of constituencies

is critical - not just for our business but for the overall effort to address ODS banks. Most individuals and groups (including the NGOs) take for granted that the Montreal Protocol has been a tremendous success but that there is nothing much left to do. After much advocacy and outreach, we and others have been successful in highlighting the short window of time to address CFCs that are rapidly being emitted, and that government mandates and government funding alone has not and will not be sufficient.

From Alex Rau of Climate Wedge Ltd.:

Hope you are well. I was surprised to be directed to your blog post on CAR’s ODS protocols yesterday and to read of your views here. While there are some merits to criticism about Article 5 imports I think you are missing the real picture here of how the Montreal Protocol works, the active resale market for ODS gases (and how it is totally different from the HFC case under CDM), the details of the protocols and distinction between end of life materials and stockpiles, and so on. Certain import projects on CAR may be a bit suspicious but US domestic projects from end of life ODS are an entirely different and far more robust project type so I think criticism like this without making clear distinctions is sloppy. The whole point of linking ODS destruction to the carbon markets is to provide a price signal to buy up ODS gases from end of life equipment that is not controlled by Montreal and will not likely be, but for which a very robust and active resale market exists to recharge old refrigeration equipment. That forms one of the biggest constituencies out there for NOT regulating these substances — not carbon credit developers, but rather the entire global old refrigeration equipment stock that requires CFCs to operate. No regulatory effort would be able to require destruction of existing banks because of the pushback from this constituency which does not want to invest in new equipment. That’s the whole point of linking ODS destruction to the carbon markets here, to provide a price signal to go out and buy up ODS from hundreds of thousands of sources and which would otherwise be resold back into leaking equipment, and destroy it permanently. This won’t happen by regulatory fiat, only a financial incentive will make this happen, which is an entirely different case from HFCs under the CDM where a simple quick fix installation on a handful of factories would solve the problem.

From Thomas Grammig of GTZ-Proklima:

Because I wrote the two public comments from GTZ-Proklima on the CAR ODS protocols,

like to react to Wara’s interpretations.

1. 100% credited on destruction date: any meth has many different parameters that add up to its overall conservativeness. CAR ODS Protocols have many overly conservative details and others overstating reductions. Parameters such as “legal and regulatory restrictions” can be related to non-legal parameters that might be more influential for overall conservativeness. In the EU all ODS recovery must prove to achieve 90% recovery rate whereas CAR ODS credits any share recovered, that in itself, is a more severe limit that the 100% credit at destruction criteria. More measured assessments of the conservativeness would do a lot of good.

2. the argument might have more merit in non-A5 countries: These ODS gases are in refrigerant circuits and in insulation foam. For both purposes only a handful of companies worldwide supply manufacturing equipment. Agramkow, Galileo, Hennecke and so on are dividing the market among them and they offer the same range everywhere so that any government can regulate at any point in time and know the actual cost difference to respective national companies using these manufacturing equipments.

3. composition of the CAR ODS workgroup: I could not agree more with Michael Wara, this group was one sided and considered only carbon business interests. I remember well during the workshop held on December 7, when one participant commented “I hear for the first time that a voluntary carbon methodology should be technologically neutral, why is this?” He was surprised that something else than profit was discussed. The best illustration of this one-sidedness is that the first version of the CAR ODS protocols from September 2009 was much more demanding than the one adopted in the end. So over the course of the Workgroup interaction, the members managed to dilute the protocols in their interest. The worst aspect is now in Appendix E that states the recovery rate can be established with a sample analysis of !ten! appliances. Since ODS content in appliances vary much between models, this allows gaming the recovery calculation freely. Some members of the CAR ODS workgroup we

re rather vicious in discrediting the quality standards available. CAR’s policy people should remember them well.

4. There are 2 other ODS protocols around that should be seen related to CAR ODS, one from the Voluntary Carbon Standard (VCS) and one from SENS International called “Swiss Charter”. The VCS 2007.1 Extension for ODS is an illustration of how to run a stakeholder consultation better than CAR. The result is that the VCS ODS standard (undergoing DOE assessment) is more costly and stringent than the CAR ODS protocols. That is a severe policy problem for CAR, demonstrating that one standard can undercut the other. However CAR is still benign compared to the “Swiss Charter” containing a ODS methodology that has never been published, never been discussed in a public forum, and whose main purpose is to capture the treatment of all CFC banks by linking it to one particular technology. Perhaps CAR feels obliged to align with VCS against the Swiss Charter.

5.the preceding point also influences the impact of CAR ODS on the Montreal Protocol. Another aspect of Wara’s argumentation seems to me important here. The promise of Montreal Protocol funds is also a disincentive for national regulation and a stronger one because Montreal funds go to governments, whereas carbon money doesn’t add to governmental coffers. Wara’s position is not plausible, destroying ODS in banks requires large investments and high operating costs. Whether Montreal funds and voluntary carbon market funds have positive or negative interactions depends on the skill of those who make rules on both sides. I would venture the prediction that when all future Montreal funds are spent and all CAR investments are realised, there will still be a lot more ODS in banks around that will end up in the atmosphere.

The HFC-23 link between Montreal and Kyoto had a unique mechanics to it. ODS in banks have a very different one and if well understood it could be positive for both. It is not that it turned out bad once, that it has to be negative again.

From Peter Miller of NRDC:

First, full disclosure. As you may know, I’m a boardmember of the Climate Action Reserve.

Second, I take seriously your concerns about process and the need to have environmental advocates represented in CAR’s working groups. But, it is not a simple matter to find environmental advocates willing and able to commit the time and effort to help develop CAR protocols, particularly on a highly technical issue like ODS destruction.

I don’t know if Thomas Grammig, whose comment precedes mine, meets your criteria of having an environmental advocacy background, but he is a strong advocate that was actively involved in the working group process and I very much appreciate and value his involvement.

More generally, I agree with you that CAR needs to have the active participation of environmental advocates with substantive technical and/or policy expertise in relevant fields in order to be effective. I would like to encourage anyone who meets these criteria to participate. And, if someone has suggestions on how to improve CAR’s process and expand working group participation, please let me know.

As for the partial overlap of the comment period with COP 15, I’ll simply note that in the current climate policy world conflicts are inevitable. If anyone has trouble meeting a comment deadline, please contact Reserve staff and let them know you will be filing late comments.

Finally, the suggestion that a COP15 side event would have been a promising venue doesn’t square with the COP15 chaos I remember so fondly. If the public meeting had been scheduled at a side event we might have had a great discussion amongst those few who were tenacious and fortunate enough to get into the Bella Center after waiting in line outside in the cold for eight hours.

Third (a substantive issue, at last), you argue that freezing a project’s baseline based on regulations in place at the time will create a constituency opposed to future regulatory actions. I would argue that quite the opposite is true. If an offset provider’s credit is linked to future regulations — as you recommend — then the offset providers will oppose future regulations. In contrast, with a fixed baseline existing projects will be indifferent to future regulations and won’t add to the already significant opposition to future regulations.

Also, while a variable baseline reduces the possibility of over crediting, it also increases risks to project proponents and would likely reduce participation. The argument that we should be willing to forego near term reductions from offset projects for the possibility of greater reductions through future regulations doesn’t strike me as a slam-dunk. I appreciate your optimism that future international action under the Montreal Protocol is likely to make a significant impact on emissions of legacy stocks over the coming decade, but I am not entirely convinced it is warranted.

Ozone depleting substances and the Climate Action Reserve: Perverse Incentives?

Some may have noted in the figures in my post from last week that the Climate Action Reserve’s portfolio of issued offsets has a heavy emphasis on the Ozone Depleting Substances (ODS) protocol. To date, about 1/3 of issued Certified Reduction Tons (CRTs) come from destruction of ODS at just one facility in Arkansas. This is also why Arkansas is the origin of the greatest number of issued CRTs to date. There are actually two ODS protocols, one for international and one for domestic ODS. These protocols, particularly the international protocol, illustrate some of the problems with the CAR process as well as some of the potential pitfalls of offsets in general and so bear further examination.

First off, a note on process. The ODS protocols were developed by a working group that included not a single person with an environmental advocacy background (see the acknowledgments to get a sense for participation in the Working Groups). This is neither good from an optics perspective nor a substantive one. Furthermore, the public workshop for this protocol and notice and comment could not have been more poorly timed to elicit participation. The workshop was held on December 7, 2009 and notice and comment period for the draft protocol were from November 20 to December 18, 2009. These dates may not seem like a problem until you consider what else people interested in international carbon markets might have been preparing for and attending at the time (hint: I do not mean Thanksgiving followed by an extended round of work-related holiday parties). So, after the working groups failed to include NGO participation, the process was poorly designed to illicit comment.

Indeed, it might have made more sense, given the international nature of what was under consideration, to hold the public meeting as a side-event at COP-15, either on- or off-site. If memory serves, the CAR was represented in Copenhagen. Now this isn’t to say that the Policy Team at CAR intended anything nefarious with their scheduling; it is to say that the schedule they chose was very poorly designed to attract participation.

Now to substance: the protocols require that a project purchase ODS from a private or public facility, transport it to a RCRA certified or equivalent ODS destruction facility within the US, and then certify the chemical’s destruction. So far so good. The question a thoughtful offsets critic might ask is, how much credit does the developer get for this? And when? The protocols give 100% credit for projected atmospheric emissions over a 10-year period on the day that the ODSs are destroyed. The protocols call this “conservative.” I would argue that it is both extremely aggressive in its GHG accounting and creates potentially perverse incentives for Article-5 (developing country) parties to the Montreal Protocol.

The accounting is aggressive because it assumes that the current legal and regulatory restrictions on ODSs will not get any stricter over the next 10 years. This makes little sense, especially for Article 5 countries, which, under the Montreal Protocol, only stopped producing the ODSs in question as of January 1, 2010. These countries might very well be in the process of developing stricter regulations concerning the capture and destruction of existing, legally produced, stocks of ODSs within their borders. The protocol ignores this possibility, blithely stating that economic incentives favor continued recycling of this material.

That argument may have had merit for non-Article 5 parties to the Montreal Protocol (developed countries) because substitutes were in the process of being invented and phased in for these countries at the same time as the ODSs were being phased out. It is less clear that the same will be the case in major developing economies where the substitutes have been in use for some time. It’s one thing to hoard your Cluorofluorocarbons when there are no competitive substitute gases or substitute compatible equipment. But that is just not the case for Article-5 parties in the present day because of the earlier phase out in the non-Article 5, developed countries.

In short, the protocol makes the most aggressive assumption possible regarding credit for ODS destruction by giving all the credit upfront for tons that might or might not have been allowed to leak over the next decade. A far more conservative assumption would have been to give credit on an annual basis based upon regulatory developments in the ODSs country of origin.

The protocol also creates regulatory incentives that disfavor domestic or international action to deal with ODS banks at agreed incremental cost. One of the key successes of the Montreal Protocol is its Multilateral Fund (MF). The MF has, over the past two decades, paid the agreed incremental costs of conversion from ODSs to safer alternatives in Article-5 nations. It has distributed more than $2.5 billion to more than 6000 individual projects. “Agreed incremental cost” means an agreed upon additional cost of an alternative technology relative to the use of the CFCs. So if for example, CFC production costs $100 million while HCFC production costs $110 million, the MF will kick in $10 million to make the net-cost to the developing country zero. Negotiation and agreement of these costs occurs at the level of the MF Executive Committee. I, amongst others, have proposed that this program might be the appropriate avenue, rather than the carbon market, for especially potent GHGs.

The US government under both the Bush and Obama Administrations, has supported extensions, first proposed by the Maldives, to the Montreal Protocol that are explicitly aimed at reducing the climate impacts of ODS. What does this have to do with the ODS protocols produced by CAR?

Creation of these protocols is, given time, likely to create a strong constituency opposed to further modifications to the Montreal Protocol that might address the existing banks of ODS. It’s worth noting that addressing these banks has been the subject of substantial study and policy analysis, most of which recommends against the use of carbon markets. Thus to the extent that the CAR protocol creates an incentive for a government to cease domestic efforts to deal with its banks of ODS, resources are likely being wasted (via inframarginal rents derived from the carbon market), more effective domestic regulation is discouraged, and international action on this important issue for the ozone layer and climate is likely delayed.

None of this context is even addressed in the protocol’s justification of additionality (of what would have happened in the absence of the carbon offset project). The protocol instead takes the view that the regulatory picture for ODS banks is static, rather than highly dynamic, and elects to freeze the regulatory picture so far as it relates to offset crediting, in the present day. This both discourages what would likely be more cost- and environmentally effective approaches to these ODS and potentially allows the use of these substances within domestic cap-and-trade schemes, thus diluting the environmental credibility of the climate initiatives. Once again, a better solution here would be to allow credit to be claimed for 10 years but to issue credits on an annual basis that takes into account the then-current regulatory picture for these gases.

My personal view is that the CAR needs to do a much better job of incorporating environmental NGOs or advocates into their protocol development process. This will help to insure both political credibility and that truly conservative assumptions regarding baselines and accounting are built into their offset protocols. Better process can lead to better substantive outcomes. Perhaps this will occur without any action on CARs part: climate policy wonk attention is rapidly shifting to California’s AB-32 implementation and away from Washington DC. But CAR’s Policy Team shouldn’t remain a passive actor in this - the ODS protocols illustrate the need to engage in active solicitation of NGO participants for the offset development process.

Can CAR transform the politics of cap-and-trade?

With the announcement by ARB that the cap-and-trade program in California would double the number of offsets allowed for compliance, I thought it was time to take a look at what we’d be buying. There are some interesting surprises…

Offsets allowed into the California system will, at least at the outset, come exclusively from an organization called the Climate Action Reserve (CAR). CAR is an organization that both develops offset protocols, issues credits based upon those protocols, and operates a registry of issued credits. The California Air Resources Board has elected to use CAR protocols for compliance grade offsets rather than developing its own. So the question arises, what exactly is in the CAR portfolio?

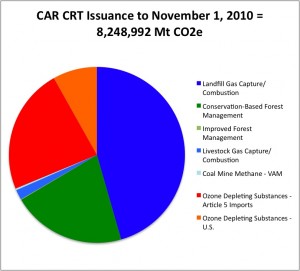

It’s early days and so far, CAR has projects have issued offsets based on 7 different protocols totaling 8.25 million tons (see Figure 1). Only 4 of these protocols (landfills, livestock, conservation forestry, and US ozone depleting substances) will be eligible, at least at the outset, for use within California’s cap-and-trade program.

Figure 1: Total issuance of CRTs by project type as of November 1, 2010.

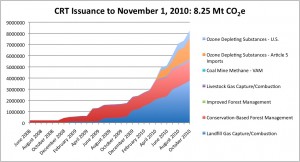

The portfolio, after a slow start, is growing quite rapidly, my estimate is that the current issuance rate is approximately 800,000 tons per month. The issuance rate will have to go up quite a bit in order to meet expected demand from the cap-and-trade, but issuance rates are increasing rapidly, particularly from landfills and ozone depleting substance protocols (see figure 2).

Figure 2: Cumulative Issuance of CRTs by month to November 1, 2010.

Perhaps the most interesting thing about the CAR portfolio is its origins - currently, CAR offsets originate in states. In fact, of the top 10 offset producing states so far, only 2, New York and California, have either operative or planned emissions trading scheme. As the California program spins up, these offsets are likely to increase in value substantially. Figure 3 shows the origin, by state, of the 8.25 million tons in the CAR portfolio. Arkansas is dominant because of a facility located in El Dorado, AR that can destroy ozone depleting substances. Together, AR, CA, NY, and TX account for just shy of 70% of issued offsets.

Figure 3: Origin by state of Issued CRTs as of November 1, 2010.

This last figure raises a question: could the development of a 50-state constituency accustomed to selling offsets into a compliance grade offset market change the politics of cap-and-trade? Remember that we don’t need a sea-change to move legislation - probably 10 votes switching sides might change the politics. The current volumes aren’t anywhere near large enough to generate that constituency, but volumes will likely grow dramatically, both as the financial incentives improve and as CAR develops new protocols that ARB allows into the cap-and-trade. Notable, CAR is currently beginning the process of developing three agricultural protocols that would have wide applicability for corn, grain, and rice producers. Perhaps the dollars and cents of offsets will, in a few years time, give a new reason to otherwise reluctant farm belt senators to think again about the merits of emissions trading. Only time will tell.

At least 1 flower blooms: CARB releases cap-and-trade draft regulation

Last Friday, the California Air Resources Board (CARB) released its draft cap-and-trade regulation for public review and comment. I haven’t had a chance to go through the entire proposal in detail yet but a few issues are immediately striking about CARBs draft rule. The rule represents a significant concession to business interests in the state that are very concerned about the costs of an emissions trading program. Is that a bad thing? Probably not in this case, largely because the toughness of the Preliminary Draft Regulation (PDR), released earlier this year, left plenty of space for CARB to make concessions to industry. The draft rule appears in its major structural components, to be one of the most thoughtfully designed cap-and-trade programs proposed to date. Mary Nichols and her staff at CARB deserve to be congratulated both for their political and their policy acumen.

Here are some of the key features of the draft rule and the differences, if any, from the earlier PDR:

(1) The cap: The final objective of the program, to return California statewide emissions of 6 greenhouse gases to 1990 levels in 2020 remains unchanged. However, the CARB wisely adjusted the schedule of interim caps that will begin in 2020 to reflect the fall in statewide emissions due to the recession. This should prevent the early carbon market from being over allocated (net long supply of allowances relative to BAU emissions) in the early years of the program. Over allocation was the cause of a notorious market crash in Phase I of the EU ETS and has caused the RGGI market to fall below RGGI Inc.’s auction reserve price.

(2) Allowance allocation: The biggest concession to industry in the draft rule has to do with the way that permits to emit GHGs will be distributed to polluters. The PDR proposed widespread auction of the vast majority of allowances with quite limited free allocation. The draft rule takes an about face on this issue and proposes free allocation for almost all major emitters. This will make the program far less costly for emitters and may even create net profits for some facilities (if compliance costs are less than the value of allowance grants). In addition, the CARB plans to use its free allocation scheme to create incentives within industries to reduce emissions. It will accomplish this by calculating a firms allowance grant based on the average carbon intensity of an industry - if a firm is below this level it will get fewer allowances than it needs, if above, it will get more than it needs. This will create some incentive to reduce emissions intensity. It’s important to emphasize that, as Rob Stavins of Harvard’s Belfer Center has pointed out, how allowances are distributed (auction or free allocation) doesn’t impact the overall environmental outcome of the program, which is set by the cap. So there is no environmental harm in free-allocation. This argument is to some extent called into question if the money raised by allowances auctions would have been used to fund additional emissions reducing activities. Given California’s budget woes, this “double dividend” was unlikely to be collected and this no doubt entered into CARB’s calculations.

(3) Offsets: The draft rule allows up to 8% of Climate Action Reserve issued offsets (known as CERTs) to be used in lieu of allowances. This is nearly twice the number in the PDR and a major concession to industry concerns regarding program costs. It makes it very important that the CAR offsets be of extremely high quality. At the same time, this quantitative limit has to be put in perspective - it’s the same number as used currently in the EU ETS and far far less than would have been the case during the early years of a federal program had Waxman-Markey been enacted into law.

(4) Strategic Reserve: New in the draft rule is the “Allowance Price Containment Reserve” (ACPR), analogous to the Strategic Reserve concept first championed by Brian Mignone of Brookings and others and eventually incorporated into the Waxman-Markey legislation. The ACPR works by withdrawing a percentage of the allowances in each year from the market. If at the time of any allowance auction, the market price for allowances exceeds $40 (increasing by 5% + CPI after 2012), then the reserve can be accessed, with more allowances being sold out of the reserve as prices go even higher. The basic idea is to provide a means to contain unexpected price volatility should it occur. The allowances deposited into the reserve are to be precisely equal to the number of extra offsets allowed - about 4% of the cap. In effect, this provides an insurance program for the offsets system. In the event that up to half of the offsets allowed into the system turn out to be problematic, and so long as prices remain at the low levels predicted by most economists who have studied the CARB proposals, then CARB will have allowances in reserve to cover the bad offsets. This proposal is really clever in that it gives industry all of the assurances that it has been clamoring for while still providing NGOs with assurances about environmental credibility. This has to be the smartest and most innovative part of the draft rule. Kudos to CARB for dreaming this deal up.

(5) Banking/Borrowing: The draft rule allows unlimited banking of allowances from earlier 3-year compliance periods into later compliance periods. No borrowing from future periods is permitted. This is unchanged from the PDR.

(6) Compliance Periods: The draft rule continues to envision a 3-year compliance period during which firms could bank and borrow freely. This will help firms to smooth compliance costs over a multi-year time frame. I and others (notably Severin Bornstein of Cal) objected strongly to this for two reasons. First, because we believe that firms should treat allowances just like any other input in the compliance process and should account for them accordingly (ideally at least on a quarterly basis). Second, because of the fear that firms would go bankrupt during the 3-year period and then default on their obligations. Long standing precedent holds that environmental liabilities are given low priority relative to other claims in a bankruptcy proceeding. The CARB struck a balance between the original proposal and responding to these concerns. They require firms to surrender 30% of their allowances each calendar year with the balance due at the end of the 3-year compliance period.

All in all, a program design that compares VERY WELL to the federal proposals after the sausage got made and even to the

Are offsets market based instruments? An information perspective

This week I participated in a series of interviews with the GAO on a new report they are preparing in implementing compliance grade offset programs (for those that are interested, the GAO has prepared excellent surveys of voluntary offset programs and of the international carbon market). Aside from wondering why they are spending (my and your) tax dollars on this issue given the political realities, the interviews sparked some new thoughts for me on offsets.

Analyses I have compiled for Congressional testimony indicate that scaling a Clean Development Mechanism-like structure to meet the demands of a US cap-and-trade system along the lines envisioned in the Waxman-Markey legislation would require at least ten times the generation rate of offsets and likely far more in terms of the regulatory effort involved. In other words, a very heavy lift for an agency and the likely the largest administrative cost of a cap-and-trade system.

This is true because the average size of offset projects in the CDM is biased by a small number of very large projects (HFC-23 and N2O) that tend to minimize the regulatory burden of issuing lots of credits. That market structure would be unlikely to exist within the US, because those projects are under the cap, or outside of it, because they are already offset projects and what is left is smaller scale. All that means a much greater regulatory burden for whoever is overseeing the supply of US offsets (EPA, the USDA, or the CDM EB).

Cap-and-trade programs appear to exhibit increasing returns to scale along the margin of regulatory effort or burden while offset programs do not. Ask yourself how many more FTEs at EPA would be needed to expand the acid rain trading program from the mid-west and eastern states to the nation as a whole. The answer is not very many at all - this cap-and-trade is administered mostly via computer networks and continuous emissions monitoring devices. But imagine a regional expansion of the same sort for an offsets program - a doubling of the emissions sources that could supply offsets would likely require an approximate doubling of administrative resources devoted to oversight on issues like baselines and additionality.

Cap-and-trade markets create strong incentives to disclose information and then utilizee a market to aggregate these disclosures into a marginal abatement cost, aka allowance price. What is increasingly clear about offset markets is that they create strong incentives for emitters to either misinform or withhold information from regulators - both in order to inflate the baseline emissions against which project performance is judged and credited. This “hide the ball” type of behavior observed in offset systems like the CDM is very similar to that engaged in by firms subject to more traditional “command-and-control” types of regulation.

Two points, one policy relevant, one conceptual emerge from this line of thinking:

Policy relevant: It isn’t obvious that an agency will realize cost-savings from a cap-and-trade if most compliance occurs via offsets. What may instead occur is a displacement of regulatory effort from capped sectors to uncapped ones. This may result in actual waste of agency resources because the system now requires monitoring of both capped and uncapped emissions.

Conceptual: Maybe the appropriate definition of a “market based” regulation is one that creates information disclosure and aggregation incentives rather than one that utilizes market-like structures to achieve compliance.

An important caveat: it remains to be seen how so-called “standardized baseline” approaches, akin to those adopted by the Climate Action Reserve, will perform as they scale. The proponents of these systems chief argument in they favor is that they minimize both agency resources and project developer transaction costs per ton of offset generated. The key question will be whether they can do so while insuring environmental quality in a diverse set of sectors and jurisdictional settings.

Climate change plays second fiddle: USTR opens investigation into Chinese clean energy subsidies

Climate change is not, and is never going to be, the first priority for either party to the US-China relationship. But playing second fiddle is one thing, becoming the cause of a global trade war is quite another.

Last month, the United Steelworkers filed a Section 301 petition with the US Trade Representative. USTR is obligated to respond to Section 301 petitions within 45 days. This statutory deadline would have tolled on October 24 - just a week and a half before the November elections. Perhaps in order to avoid this timing, USTR responded today and will commence a 90-day investigation into Chinese practices in a number of clean energy sectors.

Just when you think that things can’t get any worse on the climate diplomacy front…

This complaint is misguided in a number of respects in that it (1) ignores the benefits to US consumers of having solar panel assembly occur in China - lower panel costs, and (2) ignores the fact that at least as far as we have evidence, much of the profit associated with solar still accrues to developed world firms that maintain dominance in the high-profit portions of the solar value chain.

The real story here though is that it is beginning to appear that climate change diplomacy may become a casualty of a broader set of international relations issues. China-US cooperation on climate is essential to any multilateral deal, yet China-US relations on a number of fronts including security, exchange rates, and now trade subsidies, have been deteriorating in recent months.

We can only hope that the cooler heads prevail within both the Obama Administration and the Chinese Party Leadership - maybe we all actually do need to head to DC for John Stewart’s day on the Mall.

The possible climate impacts of rebalancing - economic policy is climate policy

Anyone who studies climate change for long concludes that development and greenhouse gas emissions are tightly coupled. This is true both here and in the developing world. The great recession has caused a large drop in greenhouse gas emission - as big as 9% in the US according to the EIA and a global drop of some 3% according to the IEA.

Now, many policy makers in the US and abroad are pushing hard on China to allow the Renminbi to appreciate substantially in value relative to the Dollar and the Euro. What would the impact of such a “rebalancing” be on Chinese and global emissions of greenhouse gases? As in all economic questions, the key question is, “and then what?”

The answer depends on what China does to cushion the blow to its export driven economy that such a currency appreciation would deliver. A central goal for Chinese state planners is maintaining levels of employment sufficient to guarantee stability. This is a big challenge in the face of a contraction due to reduced demand for exported goods.

The most likely solution to this problem might be to further lower interest rates in order to stimulate production and hence employment in various capital intensive industries. In this scenario, the Chinese economy would rebalance away from export intensive industries and towards capital intensive industry. This can’t be good for Chinese development, as it trades one macroeconomic distortion (export dependence, low domestic consumption) for another one (lots of capital stock that isn’t terribly productive). On the other hand, it would allow Chinese policy makers to satisfy Tim Geithner while also maintaining their goal of finding jobs for all of those millions of workers moving from country to city.

My thought is that It also isn’t likely to be good for either the local or the global environment. Heavy industry in China is far more energy intensive than the Chinese export industry generally, with all the concomitant resource impacts. It’s also generally more energy intensive than equivalent heavy industry in China’s main developed world trading partners. Thus rebalancing may make it harder for China to meet its domestic climate and energy objectives while also leading to a net increase in global greenhouse gas emissions.

We may well solve one (macroeconomic) problem by creating both a new economic problem and a new environmental one.

Every time I think I understand that economic policy is climate policy, I find reasons to believe I have underestimated the depth of the connection.